UNDERSTANDING FINANCIAL STATEMENTS

Understanding financial statements: Almost 80% of New Zealand business owners struggle when it comes to doing this. So, we’ve written this short guide to help you. Financial Statements are not necessarily laid out in this order (the order isn’t that important), but here are the essential bits and pieces.

The first part is the:

BALANCE SHEET

This is also known as the Statement of Financial Position. It is a statement of what your business/company owns (assets) and owes (liabilities). Assets include things like bank accounts, inventory (stock) property, cars, computers, money owed to you (debtors) etc. Liabilities include GST or tax you have to pay, holiday pay due to staff, company credit cards, loans to the bank or others, money you owe to others (creditors) and so on.

Further, it includes the amount of money that the shareholders have put into the business. Sometimes this bit is on a separate page.

Both Assets and Liabilities are often divided up into Current and Non-Current. Current Assets are those which are expected to be realised in cash, sold, or consumed within one year of balance date (generally 31 March). Obviously, Non-Current Assets are everything else. The same applies with Liabilities. If you will have to settle (pay off) the liability within one year of balance date (balance date is usually 31 March), then it is Current. If not, it is Non-Current.

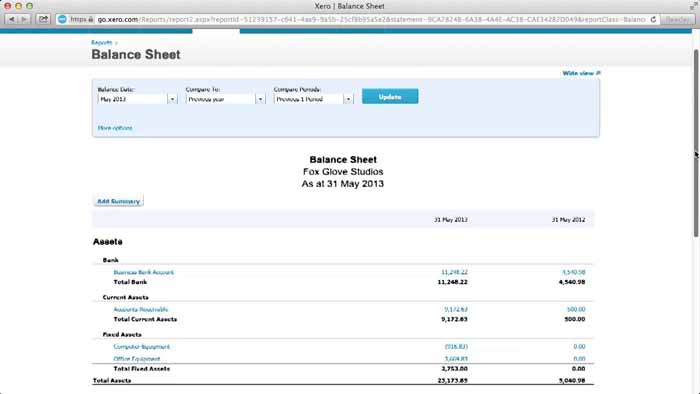

Here’s a sample one:

The next part is the:

PROFIT & LOSS/STATEMENT OF FINANCIAL PERFORMANCE

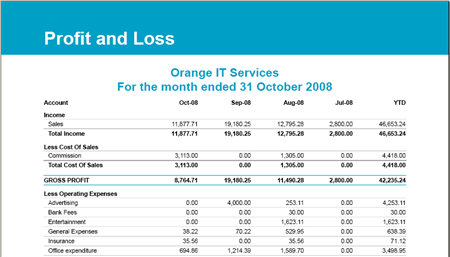

This is also known by a couple of names. You might have heard of it as the P & L. Same thing. You’ll see funds coming in (revenue) from sales, rents, interest etc. If you buy and sell products you will see entries to do with the cost of sales. This page also shows your expenses. Here’s what one looks like:

Another key part is the:

STATEMENT OF MOVEMENTS IN EQUITY

Equity is basically how much money there is in the company. If the company owns a house, for example equity is the difference between what the house is worth and how much the company owes on it. Let’s say the house is worth $300,000 and the company owes $100,000. Well, the difference ($200,000) is how much equity the company has. Over time, as you reduce the amount owed on the house or the value of the house grows, the equity increases. It’s that simple.

Here are some other common components of Financial Statements:

SCHEDULE OF DEPRECIATION

As you may be aware, when you purchase something over $1,000 (excluding GST), you can’t claim it all at once.* Instead, you claim it over the usable life of the product. This varies greatly, from 80% for a TV down to 13% for other things. The Schedule of Depreciation puts all this info in a nice neat chart.

SCHEDULE OF LOANS

This shows information about what’s owed, to whom, interest paid and so on.

SHAREHOLDERS’ CURRENT ACCOUNT

Ah, the Shareholders’ Current Account. Well, when you put money into the company out of your own pocket, that credits this account. When you take money out, it debits this account. (Don’t confuse this with reimbursing yourself for something you bought for the Company with your own money. That’s different and doesn’t enter into this account). At the end of the year we total up the ins and outs. If you took out more than you put in, then it has to be repaid to the company, or taxed in some way. (Note that if your company is a LTC then it’s a bit different, as overdrawn Shareholders’ Current Accounts are not subject to FBT; although interest must be charged to the shareholders).

COMPILATION REPORT

This is usually a page where the scope of the Financial Statements is disclosed, your responsibilities as Directors are outlined, any relationship with the Accountant is disclosed and often includes the Accountant’s Disclaimer of Liability.

ACCOUNTANT’S DISCLAIMER

This is the page where the Accountant reminds you that the buck stops with you as director(s) of the company. The Accountant has done their best to present an accurate picture of the financial state of the company, based on the information provided and their understanding and application of Tax Law. But, it’s up to you to check and make sure you’re happy with the financial statements (and that you understand them!) as it is YOU who is signing them off and YOU who are responsible in a legal sense. (For more info on your obligations as a Company Director, see this article).

NOTES

These pages contain statements of Accounting Policies, and extra detail which is not included in the main body of the Financial Statements. It pays to read these, as they have useful extra bits of information that you should be aware of.

MINUTES

These are to do with your annual meeting of the Company, as required by the Companies Act 1993.

Phew! That’s about it. If you are having trouble understanding your Financial Statements, please feel free to contact us. You might also be interested in this article, which discusses the 2014 changes to reporting requirements for SMEs

* see this article for temporary changes to asset depreciation thresholds, as a result of COVID-19

Other FAQs you might have:

WHAT IS XERO.COM?

WHAT’S THE PROCESS FOR MY TAX RETURNS?

COMMON QUESTIONS ABOUT YOUR TAX RETURNS

COMMON QUESTIONS ABOUT FINANCIAL STATEMENTS

Image courtesy of ddpavumba / FreeDigitalPhotos.net

NB: Information provided on this website is not intended to provide an exhaustive or comprehensive statement of tax law and should not be used as a substitute for considered written advice. All information published is subject to our standard terms and conditions and disclaimer

Pages

Useful Links

Services

Contact Details

Phone: 0800-890-132

Email: support@epsomtax.com

Fax: +64 28-255-08279

EpsomTax.com © 2021