HOW DO I DOWNLOAD TRANSACTIONS FROM MY BANK’S ONLINE INTERNET BANKING?

So, you need to download your loan transactions from your bank. How do you do it?

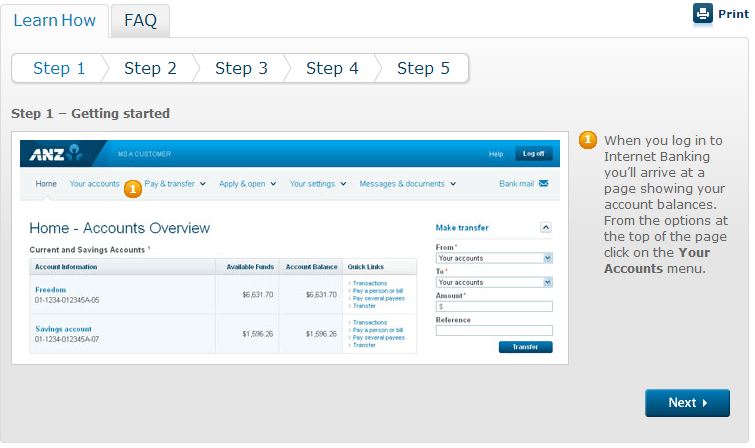

ANZ

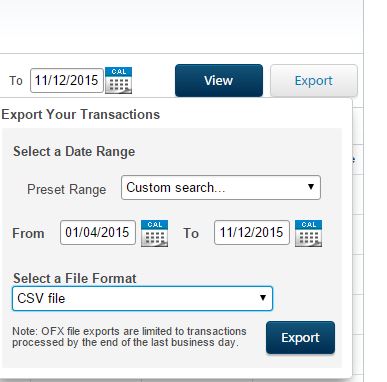

With ANZ, you’re able to view or export up to 24 months transaction history for your Everyday and Savings accounts. You can also view or download up to 24 ANZ credit card statements online. This will allow you to add your transaction history to accounting software.

Click on the account you want, and firstly select the date range, e.g. 01/04/2015 to 31/03/2016

Then click Export.Voila! You’ve downloaded the transactions. Simply repeat the process for each account. To download PDFs, go to “Select a File Format” and change to PDF, then click Export.

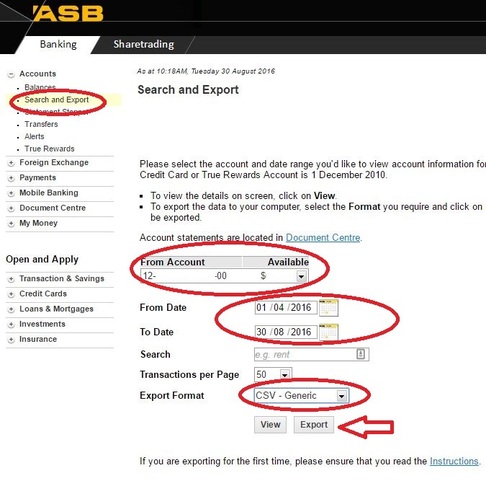

ASB

Click Search and Export. Then select the account. Next, select the From and To Dates. Then, change the export format to CSV using the drop-down arrow. Lastly, click Export and then send to us via email.

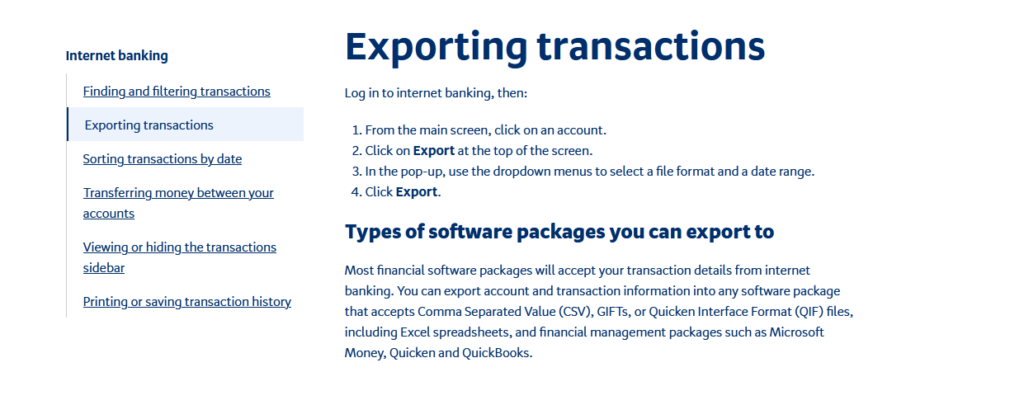

BNZ

Click the image below for a short explanation on what to do.

KIWIBANK

See the how-to guide below.

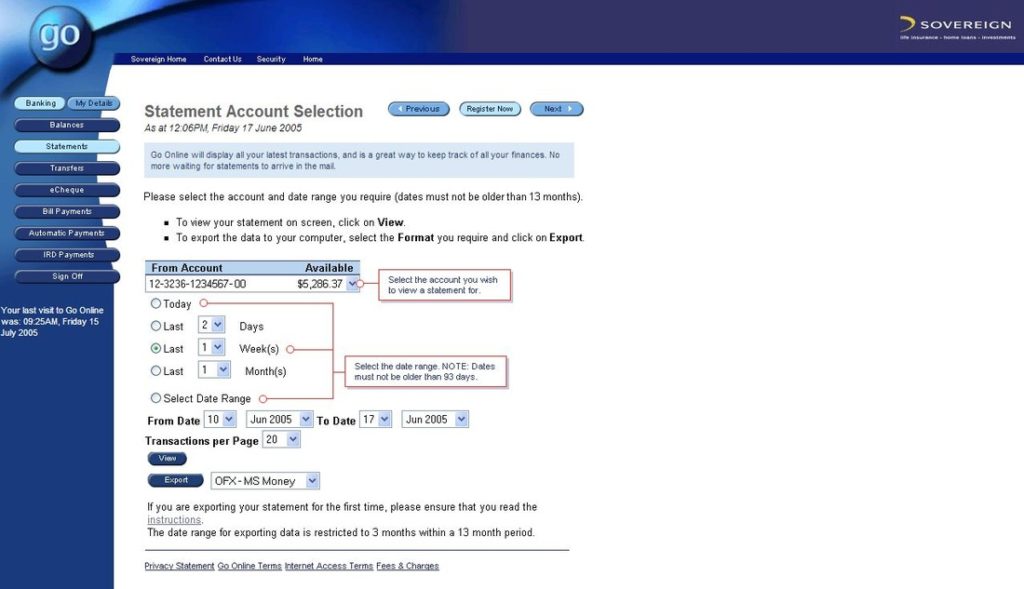

SOVEREIGN

WESTPAC

Old Westpac Banking

Firstly, login to Westpac Online Banking, and select the account whose transactions you wish to download.

You then need to change the date range. Make it from 1 April 2013 to 31 March 2014

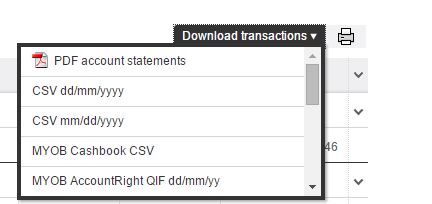

Next, click “Download transactions”. As per the picture below, a box will drop down.

Click “CSV dd/mm/yyyy”

Your transactions will automatically download. If you are using Internet Explorer, a box will pop up at the bottom of the screen. Choose “Save As” and save the file to your Desktop. You can then email it to us.

New Westpac Banking

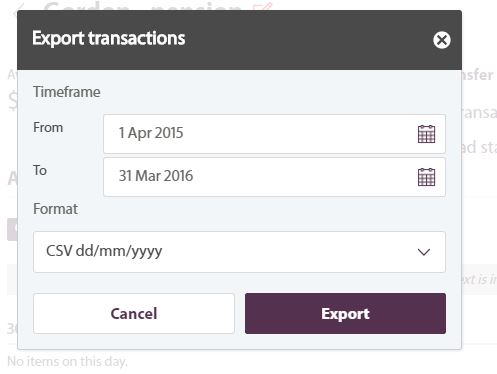

Select the account you want to export from. Click Export Transactions, then choose the date range, then the format as shown, then export, and then email to us.

NZ HOME LOANS

NZ Home Loans say:

To download your transactions, “select the account you wish to get these transactions for, this will bring up all previous transactions. In the yellow box you can change the date range if needed and there is an option to export these. There are a couple of different export options which include what you need – CSV.”

For help, call NZ Home Loans on 0800 332 837 or visit their website.

HELP?!

Need help? Don’t panic. Call us on 09 973 0706 or 0800 890 132

Other FAQs you might have:

RENTAL PROPERTY: WHAT RECORDS DO YOU NEED TO KEEP?

ONLINE TAX QUESTIONNAIRE

HOW DO I DOWNLOAD TRANSACTIONS FROM MY BANK’S ONLINE INTERNET BANKING?

WHAT IS XERO.COM?

WHAT’S THE PROCESS FOR MY TAX RETURNS?

All logos reproduced here are subject to copyright and belong to their respective owners. EpsomTax.com does not claim association with or endorsement by any of the above entities.

Pages

Useful Links

Services

Contact Details

Phone: 0800-890-132

Email: support@epsomtax.com

Fax: +64 28-255-08279

EpsomTax.com © 2021