COMMON QUESTIONS ABOUT YOUR TAX RETURNS

Have you got tax return questions? Great! We try to answer them. This page is not in alphabetical order, but in order of Top Questions first:

TAX RETURN FILING DATES

Q: When does my tax return have to be in i.e. filed with IRD?

A: If you have an Extension of Time to file, the date is 31 March. If you are linked to a Tax Agent or Accountant, then usually you will have this extension. Note that the IRD must receive your tax return by this date i.e. if you post it on this date, it will be late.

Q: Cool, so I can send my info to you guys about the middle of March and that will be ok then? That gives 2 weeks to get it sorted, right?

A. Sorry, but no. In order to get the figures right, there is a process of many eyes checking your financial statements/tax return/s. So we recommend that you allow at least 5-6 weeks for us to collate, code, compile, check and file your financial statements and tax returns.

NO INCOME?

Q: I didn’t earn any income last year, but I am a shareholder in a Look Through Company. Do I have to file a tax return?

A: Yes. You will have income or loss from the LTC and this has to be declared to Inland Revenue via a personal tax return.

Q: My rental is running at a loss. Why don’t I get a tax refund anymore?

A: You can blame the government for that. They changed the rules so that losses from rental residential property, are “ring-fenced”. That means they can only be offset against profits from the same kind of income. Read more here. What do do about it? Read about our recommended strategies here.

LTC LOSSES

Q: I don’t see any impact of the LTC losses to the final tax figure?

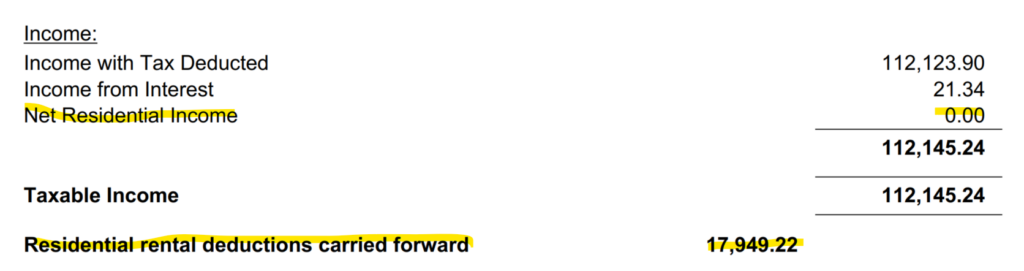

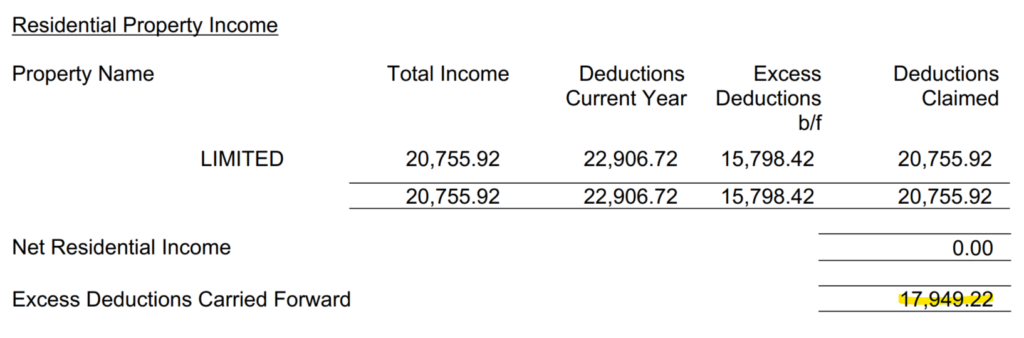

A: Please see the excerpts from an IR3 tax return with rental loss from an LTC below

So, as you can see from the first image, the initial tax return page only shows a net figure and loss to carry forward. Page two has a breakdown – we have removed the name of the LTC (which is why it just says LIMITED) – showing total rental income, deductions claimed this year, deductions from prior years brought forward, amount claimed and then excess deductions (what is left over) to carry forward to next year.

HOW DO THE AMOUNTS ON THE PROFIT & LOSS RELATE TO MY TAX?

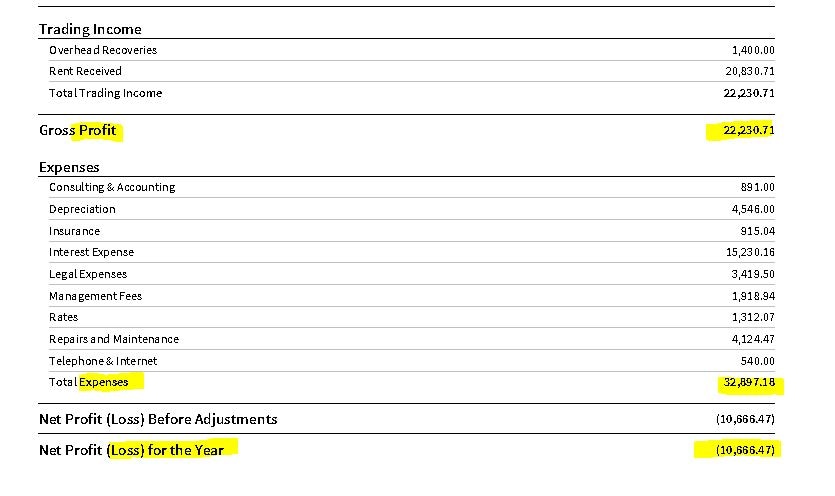

Here is a typical Profit & Loss report. You can see the Profit hi-lighted in yellow, and the Expenses hi-lighted below (also in yellow). Then at the bottom, you can see that the result is a Loss – which is why it is written in parentheses (brackets).

This loss amount (or negative amount) is then put on your tax return. It offsets other rental income you have received. In this sample, assuming the person is being taxed at 33c in the dollar (ie they earn over $70,000 per year), then they could offset the loss of nearly 11k against other rental income (or if they have none, then this loss would be carried forward to future years).

HOW IS THE TAX CALCULATED?

All sources of income are added, e.g. wages, interest, dividends. Next, all sources of loss are added, e.g., LTC losses. Then tax is calculated on the sum of all of these figures. After that, tax that you have already paid is deducted, e.g., RWT, PAYE, provisional tax. The resulting figure is either a debit (tax to pay) or a credit (a tax refund).

DIVIDENDS – AECT/ENTRUST

Q: Why does the IR3 (personal tax return) you sent me show a dividend of nearly $500 from Entrust (formerly the Auckland Electricity Consumer Trust or AECT)? I only got about $300-something?

A: The Entrust dividend is shown on the tax return as follows

- gross dividend

- less dividend imputation credits

- less dividend withholding tax

Using this formula, we arrive at the $300-something you received. You can see the exact breakdown here

REFUNDS

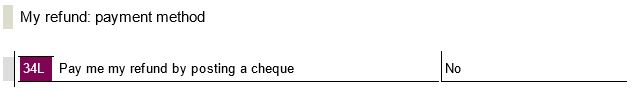

Q: Why does the tax return show this? I wanted the refund to be credited to my bank account?

A: That’s exactly what this means. It says, in effect: “do you want to receive the refund in cheque format?” The answer is “No.” IRD only gives one other option, and that is a refund to your bank account.

Q: Does my LTC get a refund as well as me?

A: No. If you have an LTC, the refunds go to you. The company is Looked Through at tax time, hence the name Look Through Company.

RESULTS

Q: Is the amount shown as a refund what we’re going to get?

A: Probably. All returns filed are subject to review by IRD, and sometimes they don’t agree with our calculations. There are a number of reasons for this:

- debts or credits we may not be aware of

- keying errors by IRD/ourselves

- other factors

However, don’t panic. All errors, wherever they are made, can be easily rectified.

JARGON

Q: What’s an IR3 form? What’s an IR526? How long does it take to file a return?

A: That is what the personal tax return form is called: an IR3. (If you are not NZ tax resident, the form is an IR3NR). The actual filing online takes about half an hour. Then IRD processes it, which can take anywhere from 1 week to 12 weeks or longer. Once they’ve processed it, you then receive your tax refund.

The IR526 is the donations rebate form; it has to be processed separately. Note that you can now login to myIR and upload your own donations during the year, and IRD will process them once your personal tax return is done.

ACC

Q: I own a rental property, or I’m self-employed. Why is ACC sending me a bill?

A: If you received rental income in NZ and you didn’t use a property manager, ACC can still charge you. And if you are self-employed, you have to pay ACC Employer and Earner Levy

These questions are based on questions asked by customers.

Other FAQs you might have:

RENTAL PROPERTY: WHAT RECORDS DO YOU NEED TO KEEP?

USING MY TAX QUESTIONNAIRE

HOW DO I DOWNLOAD TRANSACTIONS FROM MY BANK’S ONLINE INTERNET BANKING?

WHAT IS XERO.COM?

WHAT’S THE PROCESS FOR MY TAX RETURNS?

COMMON QUESTIONS ABOUT YOUR FINANCIAL STATEMENTS

Recent Posts

Pages

Useful Links

Services

Contact Details

Phone: 0800-890-132

Email: support@epsomtax.com

Fax: +64 28-255-08279

EpsomTax.com © 2021