I’M A NZ TAX RESIDENT WITH OVERSEAS INVESTMENT PROPERTY. DO I HAVE TO PAY NRWT? OR AIL?

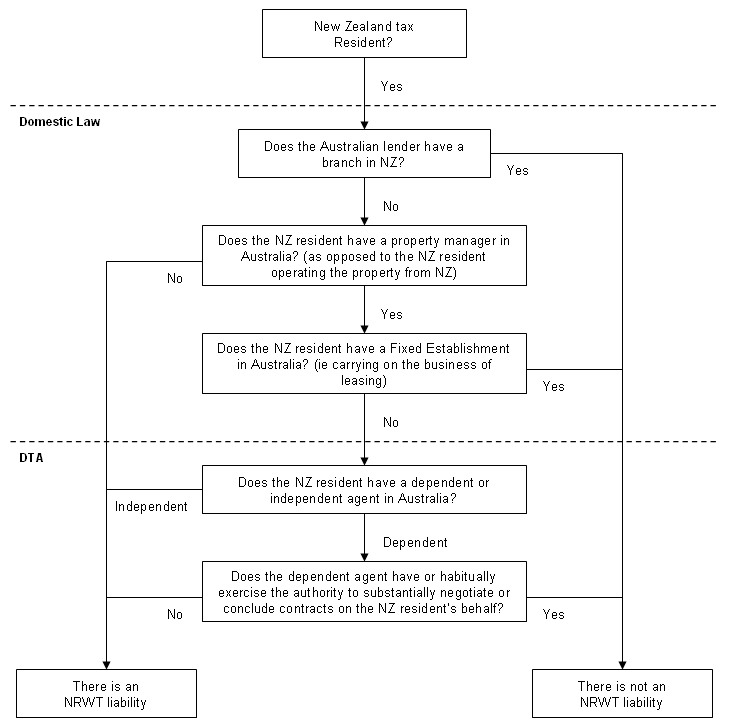

Good question. The best answer is: look at the flow-chart below (kindly provided by IRD)

Basically, if you have overseas investment property and you have a mortgage with an overseas bank, then you might have to pay NRWT.

NRWT is Non-Resident Withholding Tax. Essentially, if you’re paying interest, dividends or royalties to people (and banks, e.g. a mortgage with an overseas bank) who aren’t New Zealand tax residents, you’ll need to deduct NRWT. However, there are exceptions. We’ll write some more about that soon, but here’s a link to check out in the meantime.

The other alternative is to pay AIL (Approved Issuer Levy). If you pay interest to a (non associated) non-resident lender, and want to pay it at a zero rate of NRWT, you have to apply to Inland Revenue to become an approved issuer. Instead of deducting NRWT, approved issuers must pay a levy on the securities they register with Inland Revenue.

Again, we’ll write some more about this later, but here’s some bedtime reading on the subject.

ARE YOU A “CASH BASIS” PERSON?

What we refer to above is known as a financial arrangement, ie if you have overseas investment property and you have a mortgage with an overseas bank. IRD says that if you are a “cash basis” person, you have to account for changes +/- in foreign currency as well!

Here’s how to tell:

The criteria for a person to be classified as a Cash Basis Person are that the value of all financial arrangements of the person do not exceed certain values and that there is not a difference between accrual and cash recognition exceeding $40,000. This $40,000 is cumulative from year to year.

The rules under the first criterion are that one of the following is satisfied:

- income and expenditure under all financial arrangements for the income year does not exceed $100,000, or

- the absolute value of all financial arrangements to which the person is a party on every day of the income year does not exceed $1 million with that value calculated on the basis of:

- face value for a fixed principal financial arrangement

- the amount owing for a variable principal debt instrument, and

- the value determined under the old financial arrangements rules if they apply to the financial arrangement.

And…

- The overall $40,000 threshold requires the application of a formula to all financial arrangements to which the person is a party. The product (difference between the income on a cash and accrual basis) cannot exceed $40,000 if the person is to be a cash basis person.

NOPE. NO IDEA!

Still stuck? Contact us or your tax professional

Recent Posts

Pages

Useful Links

Services

Contact Details

Phone: 0800-890-132

Email: support@epsomtax.com

Fax: +64 28-255-08279

EpsomTax.com © 2021