WHAT’S THE PROCESS FOR MY TAX RETURNS?

What’s the process for my tax returns? We thought it might be helpful to step you through how it works; that is, the bit we do.

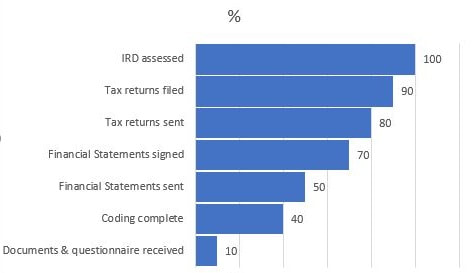

SIMPLIFIED VERSION

Here are the main steps involved, and an approx. % showing how far through we are at each point. The chart starts at the bottom, and the top is 100%, tax returns filed and assessed by IRD!

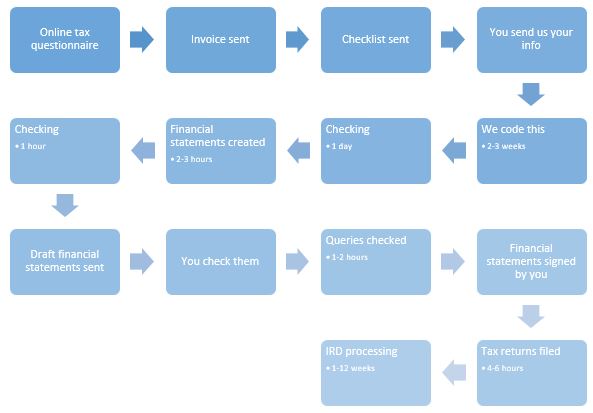

DETAILED VERSION

Here is a detailed description of each part of the process

- First, we email you a link to the online tax questionnaire. We ask you to complete this within 7 days of receipt.

- We send you an invoice via Xero.com for 50% of the job. (Some small jobs are billed 100% up-front).

- We’ll then send you a copy of your completed questionnaire, along with further instructions

- You then either email your info to mytaxinfo@epsomtax.com or send it via courier (let us know and we’ll send you a bag to return to us.

You just call the courier on their toll free number, and they collect it from wherever you tell them to). Once we receive your info, we then scan it and courier it back to you after the tax returns are filed.

5. By now, it’s the first of the month, you’ve sent us all of your info, and we then copy this to secure online storage.

6. We start coding your info up to trial balance stage; the second 50% invoice is issued, usually a 14-day account.

7. Financial statements are compiled.

8. A checker reviews the draft financial statements and any adjustments made.

9. Drafts are then sent to you for review (see how to understand your financial statements), adjustments made, and then we send you the final version of the financial statements.

10. Next, tax returns are queued to be filed online with Inland Revenue and checked again by the filing and checking team.

11. We send you a copy of these returns for your records and for you to sign and return back to us.

12. IRD processes the returns. (Here’s how to create a myIR account and check progress)

13. After that, we process the donation tax credit forms.

TIMEFRAMES – HOW LONG DOES IT TAKE?

As a rough guide, from the date of invoice issuance to you having the draft financial statements in your hands, we aim for 6 weeks, subject to this disclaimer: these timeframes are indicative only and at peak times of the year e.g. May-October, it will often take longer (like 8-9 weeks)

Before Processing Starts

- 2-3 weeks before – tax questionnaires sent out via email

- 1-2 weeks before – 1st invoice sent out via email

Processing Month

We’ll advise you in February or March via email when this is.

- 1st of the month – all data should be provided by you by this date; processing starts

- 3-4 weeks later – work completed to draft stage; second invoice issued

- 7 working days later – 2nd invoice paid, draft financial statements sent to you for review

- 7 working days later – changes made as required, confirmation received from you to file with IRD

- 1-2 weeks later – tax returns filed

- 1-12 weeks later – IRD processes returns.

We trust this helps take some of the mystery out of the process. Please contact us with any questions!

Other FAQs you might have:

RENTAL PROPERTY: WHAT RECORDS DO YOU NEED TO KEEP?

HOW DO I DOWNLOAD TRANSACTIONS FROM MY BANK’S ONLINE INTERNET BANKING?

WHAT IS XERO.COM?

COMMON QUESTIONS ABOUT YOUR TAX RETURNS

COMMON QUESTIONS ABOUT YOUR FINANCIAL STATEMENTS

Pages

Useful Links

Services

Contact Details

Phone: 0800-890-132

Email: support@epsomtax.com

Fax: +64 28-255-08279

EpsomTax.com © 2021