Posts Tagged ‘how to’

INVESTING IN NEW ZEALAND PROPERTY

Investing in New Zealand Property: A Comprehensive Guide Investing in property has long been a favored avenue for wealth accumulation and financial security. With its picturesque landscapes, stable economy, and welcoming atmosphere, New Zealand stands out as an attractive destination for property investment. Whether you’re a foreign investor eyeing the Kiwi market or a local…

Read MoreGST APP TAX REGULATIONS: WHAT YOU NEED TO KNOW

GST app tax regulations: What you need to know! Commencing April 1, 2024, platforms offering ride-sharing, food delivery, and short-term accommodation services – “listed services” as per the legislation – will be mandated by law to levy GST on these services. These are platforms such as Airbnb, VRBO, Expedia, Uber and so on. This obligation…

Read MoreNAVIGATING THE CRYPTO LANDSCAPE: HOLDING, STAKING AND TRADING

Introduction Navigating the Crypto Landscape: Holding, staking and trading; it can appear quite daunting! Cryptocurrency has taken the financial world by storm, offering innovative ways to invest, earn passive income, and trade digital assets. In New Zealand, as elsewhere, navigating the world of crypto can be both thrilling and daunting. Thus, in this comprehensive guide,…

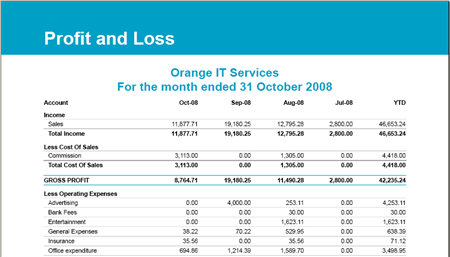

Read MoreUNDERSTANDING FINANCIAL STATEMENTS

It is a statement of what your business/company owns (assets) and owes (liabilities). Assets include things like bank accounts, inventory (stock) property, cars, computers, money owed to you (debtors) etc.

Read MoreHOW TO USE TAX POOLING

PAY YOUR INCOME TAX HOW AND WHEN IT SUITS YOU How to use tax pooling: Tax Management NZ (TMNZ) provides an IRD-approved service that gives small businesses greater flexibility to do tax on their terms by letting them choose how and when they make their income tax payments. UPCOMING PROVISIONAL TAX PAYMENTS Generally, you’ve got to pay…

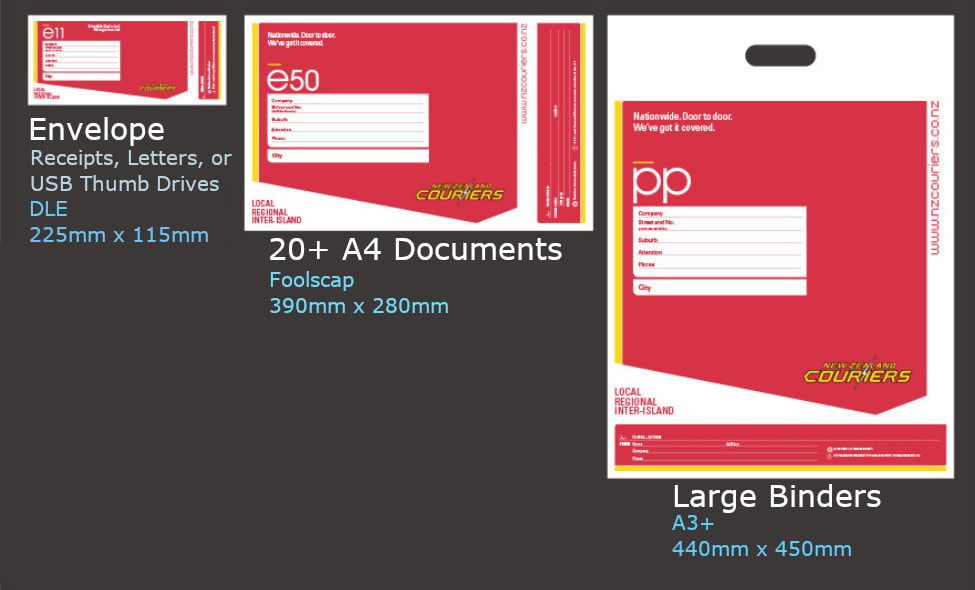

Read MoreCOURIER BAG REQUEST

PROVISIONAL TAX CHANGES

PROVISIONAL TAX CHANGES From the 2018 income year (that is, 1 April 2017 onwards), the safe harbour threshold has been increased! Hooray, I hear you say. It’s gone from $50,000 to $60,000. It has also been extended to non-individual taxpayers e.g. companies. What does this mean? Use of Money Interest (UOMI) will only be payable…

Read MoreWHY YOU SHOULD (ALMOST) ALWAYS GET CHATTELS VALUED

Why is a chattels valuation necessary? Why you should always get chattels valued: In exploring the necessity of a chattels valuation, it’s crucial to delve into the intricacies of property assessment and taxation. While standard valuations typically assign a modest value to chattels, often ranging from $10,000 to $15,000, they frequently overlook numerous depreciable items…

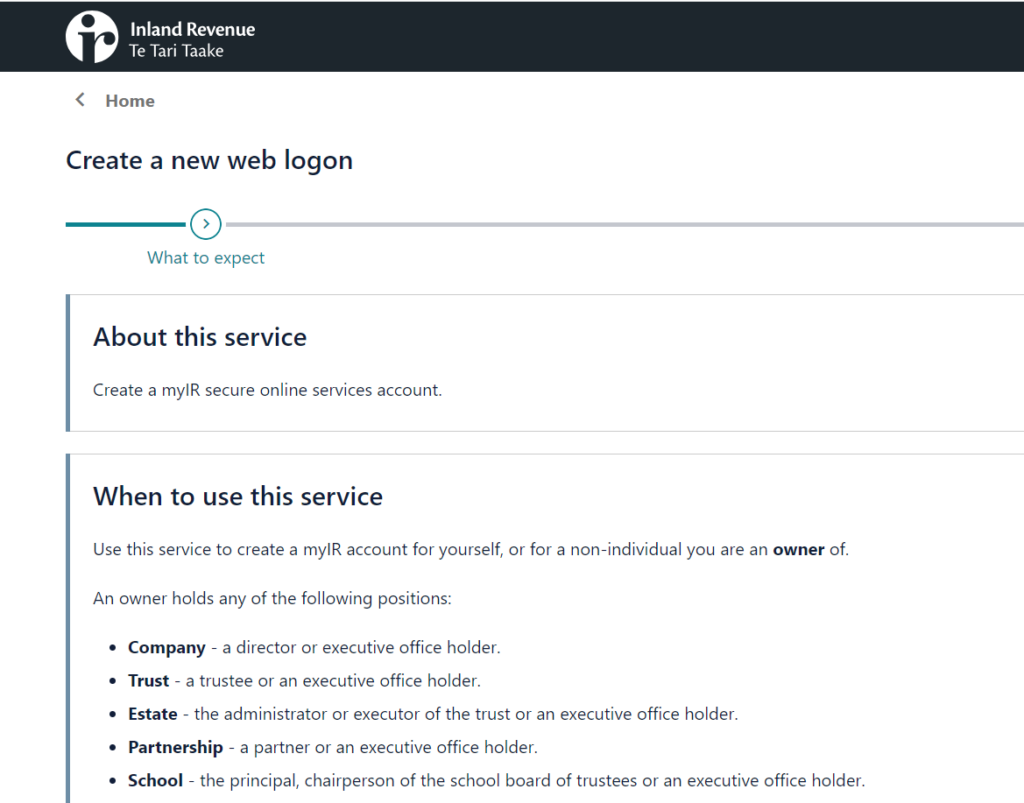

Read MoreHOW TO CHECK ON THE PROGRESS OF YOUR TAX RETURN PROCESSING AT IRD

Make sure the address in the bar at the top is https://myir.ird.govt.nz/tools/_/. This is to make sure you haven’t ended up at a fake website. There should also be a little padlock showing in the title bar at one end.

Read MoreNOT ALL PROPERTY MANAGERS ARE CREATED EQUAL

Not All Property Managers Are Created Equal “Not all property managers are created equal.” What do we mean by that? Well: In an industry where all companies promise to “take the stress out” of property investment and offer a free lunch for your rental business it is increasingly difficult to choose the right property management…

Read More