Posts Tagged ‘taxes’

COMMON QUESTIONS ABOUT YOUR TAX RETURNS

COMMON QUESTIONS ABOUT YOUR TAX RETURNS. Have you got tax return questions? Great! We try to answer them. Top questions first

Read MoreARE TAX BENEFITS A GOOD REASON TO CHANGE COMPANY SHAREHOLDINGS?

Previously you both earned about the same, but now there is a child in the mix, and one of you is working less as a result, and earning less as a result.

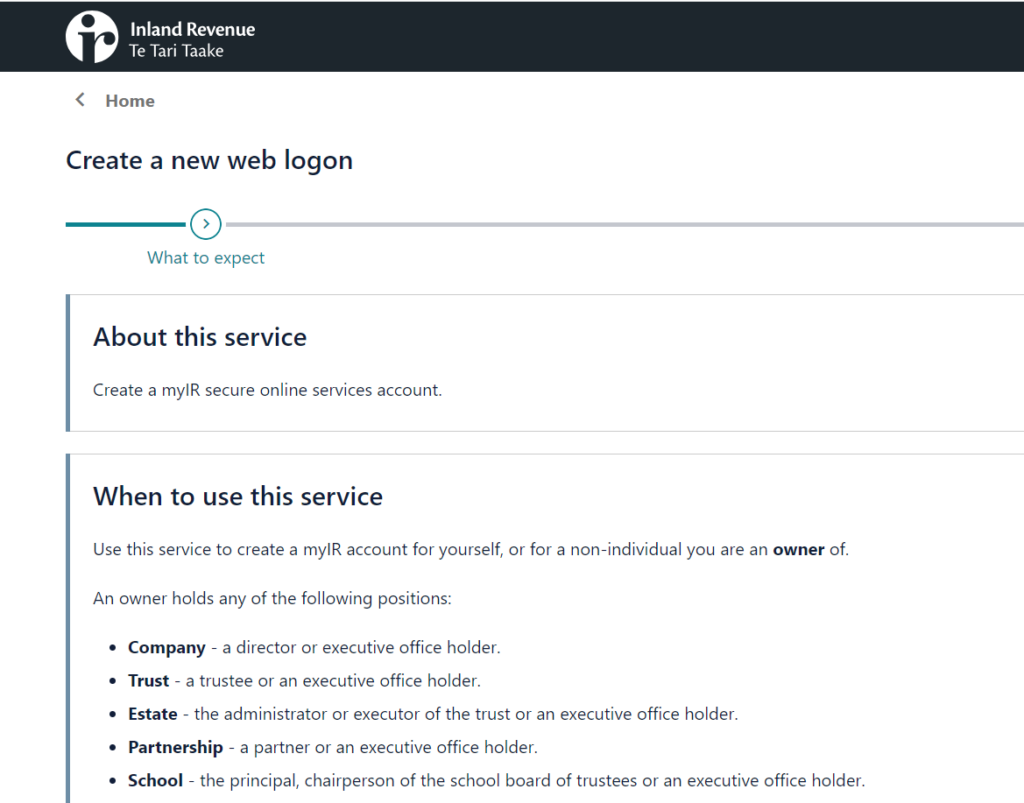

Read MoreHOW TO CHECK ON THE PROGRESS OF YOUR TAX RETURN PROCESSING AT IRD

Make sure the address in the bar at the top is https://myir.ird.govt.nz/tools/_/. This is to make sure you haven’t ended up at a fake website. There should also be a little padlock showing in the title bar at one end.

Read MoreWHAT IS TAX POOLING?

big corporates like the banks overpay their provisional tax. In the past, they would overpay it to IRD, and get a miserable interest rate. Companies like TMNZ came along

Read More“IRD RISK REVIEW” VS IRD “REQUEST FOR MORE INFORMATION”

Facing an IRD Risk Review is a scary thing. You might have read about Audits, and Risk Reviews. But what does the process (sometimes) look like?

Read MoreSHOULD I GET THE COMPANY TO BUY ME A CAR?

SHOULD I GET THE COMPANY TO BUY ME A CAR? That’s a good question. It depends on whether your company is a Look Through Company (LTC) or not

Read MoreCHANGES TO FINANCIAL REPORTING REQUIREMENTS FOR SMES

ou might have heard of the Financial Reporting Act 2013 and the Financial Reporting (Amendments to Other Enactments) Act 2013. Maybe not. Anyway, changes which took effect on 1 April 2014 mean that entities that do not meet the large entity definition will no longer be required to prepare financial statements in accordance with NZ GAAP.

Read MoreARE THE LOSSES FROM MY RENTAL IN NZ TAX-DEDUCTIBLE IN AUSTRALIA IF I’M WORKING THERE? PART 2

does the ATO allow losses from rental property in New Zealand owned by a New Zealand LTC to be offset against personal waged income earned in Australia?

Read More